Premium perks, rewards and travel experiences await with the Amex Preferred Rewards Gold!

This card offers travel perks, everyday rewards, and access to exclusive experiences, giving UK customers meaningful value. In this persuasive American Express® Preferred Rewards Gold Credit Card review, discover how it stands apart.

The card’s annual fee is waived in the first year, giving users a chance to fully explore features before committing. Airport lounge access and welcome points improve the journey.

As a versatile financial tool, it provides opportunities for everyday savings while also enhancing lifestyle benefits. Its balance of rewards, protections, and extras ensures users experience substantial value long-term.

| Feature | Details |

| Representative APR | 86.8% variable (including annual fee), 29.7% variable on purchases in the first year |

| Intro Offer | 20,000 points bonus (or 40,000 with limited promotion) after qualifying spend within three to six months |

| Annual Fee | £0 for the first year, £195 per year from year two onward |

| Credit Limit | From £700 up to £25,000 depending on applicant’s financial circumstances and credit score |

All rates, fees, and offers were accurate at the time of writing but may change. Please check American Express’ official website for the latest details.

Is this a good option for me?

This card is aimed at people who travel, dine, and shop frequently, helping them maximize points and rewards. Its combination of lifestyle perks and protections appeals broadly.

Members earn one point per £1 spent, with double points on airlines and foreign currency, and triple on bookings via Amex Travel. This versatility defines the American Express® Preferred Rewards Gold Credit Card review.

The generous welcome bonus, travel perks, and dining privileges make it attractive. Even after the free first year, many consider the ongoing annual fee worth paying for benefits.

Generous Welcome Bonus

Applicants receive 20,000 Membership Rewards points upon spending £3,000 in the first three months. A limited promotion boosts this to 40,000 points with £5,000 spent.

These points are flexible, transferable to Avios and other partners, and valuable for frequent travellers. They can reduce flight costs or enhance experiences, delivering tangible returns immediately after approval.

Everyday Earning Power

Everyday spending is rewarded consistently. Cardholders earn one point per £1 on almost everything, plus extra multipliers with airlines, foreign currency, and Amex Travel, ensuring rapid accumulation of points.

This balance of strong earning categories with everyday usability ensures relevance. For many, this flexibility is a central strength highlighted in any American Express® Preferred Rewards Gold Credit Card review today.

Travel Privileges

The card includes four Priority Pass lounge visits annually, offering comfort, refreshments, and Wi-Fi access. Additional entries are available at discounted rates with straightforward enrollment and card activation.

Travelers also benefit from travel accident insurance, purchase protection, and access to exclusive Amex Experiences. These ensure peace of mind and added value during both domestic and international trips.

Lifestyle Extras

Dining rewards, access to curated events, and hotel booking privileges deliver more than financial benefits. Through Amex Offers, cardholders enjoy discounts on shopping, dining, and entertainment purchases across the UK.

Hotel Collection bookings (two nights minimum) unlock up to $100 hotel credit at checkout and potential room upgrades, further enhancing lifestyle value for those who travel frequently.

Car Rental and Partner Benefits

The cardholder receives discounts of 10% with Hertz and free Avis Preferred Plus membership perks, including upgrades when available. This adds convenience and savings for UK travelers booking vehicles.

Paired with shopping and entertainment offers, these extra features complete the package. They ensure the American Express® Preferred Rewards Gold Credit Card review demonstrates value beyond rewards and annual bonuses.

Review the American Express® Preferred Rewards Gold Credit Card fees and interest rates

This card has a transparent fee structure, starting with a waived annual fee in the first year, then applying ongoing charges from the second year onward.

With a representative APR of 86.8% variable (including fee) and purchase APR of 29.7% variable, it’s essential to understand costs in this American Express® Preferred Rewards Gold Credit Card review.

Fees explained

- 🔹 Annual fee: £0 in the first year, then £195 from year two onward, reflecting premium benefits offered.

- 🔹 Late payment fee: £12 charged for missed or delayed payments, emphasizing the importance of timely monthly repayments.

- 🔹 Foreign transaction fees: No additional charge for transactions in non-sterling currencies, enhancing value for travelers spending abroad regularly.

Interest Rates explained

- 🔸 Representative APR: 86.8% variable overall, calculated by factoring in the annual fee and other conditions.

- 🔸 Purchase APR: 29.7% variable in the first year, before fees apply.

- 🔸 Cash advance APR: Higher interest rate applies to cash withdrawals, and interest accrues immediately, discouraging frequent use of this function.

What can this credit card do for me: pros and cons

The balance of travel perks, lifestyle benefits, and welcome bonuses make this a powerful financial product, but there are also limitations potential applicants must carefully weigh.

Comparing all benefits and drawbacks in an American Express® Preferred Rewards Gold Credit Card review ensures a realistic perspective. This empowers applicants to apply confidently knowing exactly what to expect.

Pros

- ✅ Flexible rewards: Points earned on everyday spending, with multipliers on travel purchases and Amex Travel bookings, maximizing earning potential.

- ✅ Welcome bonus: Substantial sign-up offer provides immediate value, usable across travel, retail, and partner transfers.

- ✅ Travel perks: Four annual lounge visits, hotel collection extras, and dining offers improve leisure and work travel.

- ✅ Lifestyle benefits: Hotel credits, event access, and Amex Offers provide consistent value beyond pure travel perks.

- ✅ First year fee waiver: Allows applicants to test value before committing to the annual cost from year two onward.

Cons

- ⚠️ High APR: Representative APR of 86.8% variable may deter applicants carrying balances monthly.

- ⚠️ Annual fee: £195 from year two is a significant ongoing cost unless benefits outweigh spending patterns.

- ⚠️ Limited acceptance: American Express is not as widely accepted as Visa or Mastercard in some UK merchants.

- ⚠️ Eligibility requirements: Stronger credit profiles are typically required, reducing accessibility for applicants with limited history.

- ⚠️ Complex value calculation: Benefits heavily depend on lifestyle fit, making the card less ideal for infrequent travelers.

Can I apply for this credit card?

Eligibility depends on individual circumstances, including income and credit history. The application process is online and straightforward, with decisions often provided quickly and efficiently to applicants.

In this American Express® Preferred Rewards Gold Credit Card review, it’s essential to highlight that a strong financial history increases approval chances. Creditworthiness and responsible repayment records play important roles.

- ✔️ Minimum age: Applicants must be 18 or older at the time of applying.

- ✔️ Residency: Permanent UK residency is required for all applicants.

- ✔️ Credit history: A strong record of repayment and responsible borrowing boosts chances of approval.

- ✔️ Financial stability: Demonstrated income sufficient to handle repayments and spending obligations strengthens eligibility.

How to apply for the American Express® Preferred Rewards Gold Credit Card!

The process to apply is designed to be quick and digital, minimizing barriers for qualified applicants while still protecting lenders from excessive risk. Applicants can complete forms entirely online.

In this American Express® Preferred Rewards Gold Credit Card review, applying online through the official website is the recommended path, ensuring applicants access the latest offers and eligibility tools available.

Step 1: Review eligibility

Applicants should first use Amex’s online eligibility checker to determine approval likelihood. This avoids unnecessary impact on credit scores before proceeding to a full application submission.

Eligibility tools provide insight without harming credit history. They also highlight required information, reducing uncertainty for applicants and streamlining the overall process effectively.

Step 2: Complete the application form

Online applications request personal, financial, and employment information. Details about income, debts, and expenses help determine suitability and creditworthiness for this premium product.

Applicants who complete the form carefully and truthfully maximize chances of approval. This transparency is essential when beginning an American Express® Preferred Rewards Gold Credit Card review.

Step 3: Submit supporting information

Some applicants may be asked for additional documents, such as proof of income or address. Digital uploads speed up the process and improve decision-making timelines significantly.

Providing documents quickly ensures no delays. Most applicants can proceed to instant decisions after submitting all information requested, making this step seamless in the overall journey.

Step 4: Receive approval decision

American Express often delivers instant decisions online. Applicants either gain immediate approval or are contacted for more information before a final outcome is determined.

Fast decisions reflect Amex’s digital-first approach. This efficiency is appealing for many readers evaluating steps in an American Express® Preferred Rewards Gold Credit Card review.

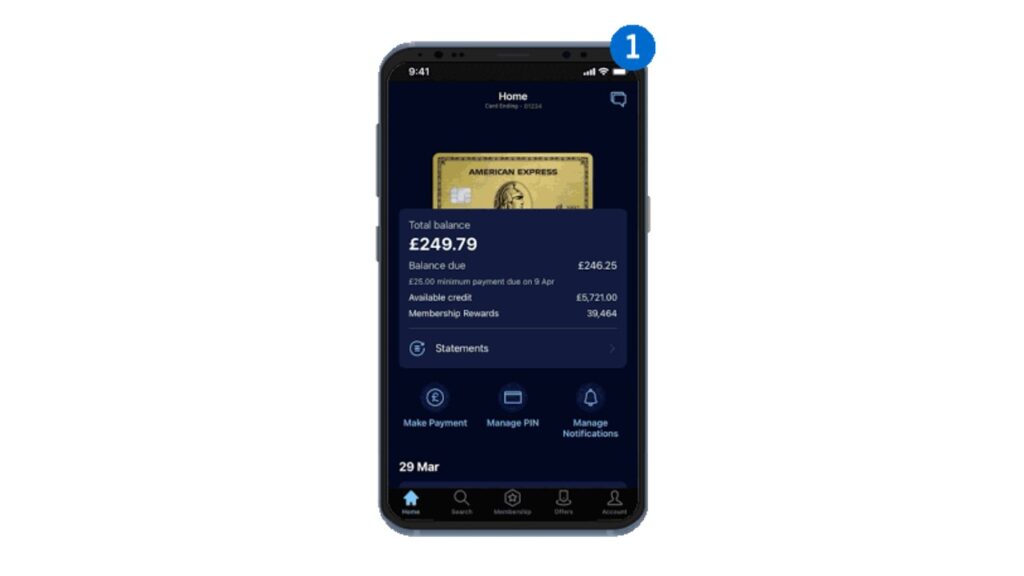

Step 5: Activate your card

Once approved, the card arrives by post. Activation is done online or by phone, unlocking all benefits and allowing immediate use for everyday and travel purchases.

This final step confirms access to lounge visits, offers, and rewards. It concludes the journey effectively within an American Express® Preferred Rewards Gold Credit Card review.

Is the American Express® Preferred Rewards Gold Credit Card really worth it?

This card is often praised for its balance of rewards, travel perks, and lifestyle features, especially with the first year being fee-free for all new members.

An American Express® Preferred Rewards Gold Credit Card review highlights how strong multipliers, lounge visits, and welcome bonuses offset annual costs for frequent travelers, but less so for occasional spenders.

Applicants should carefully assess lifestyle fit. Those who travel regularly or spend heavily benefit most, while casual users may find limited day-to-day value compared with alternatives.

For those wanting an alternative, consider the TSB Platinum Purchase Credit Card. Compare the full review to see how it stacks up and suits your unique needs.

TSB Platinum Purchase Credit Card Review

Spread your purchases, enjoy extended interest-free months, and manage your money smarter with this flexible card designed to help you stay in control.