Discover a simple credit card designed to help improve your score and give you control from day one.

Starting from a modest credit limit, this card offers a no-fee opportunity to rebuild your credit from scratch. It’s designed for financial growth when used wisely. Perfect for this Capital One Classic Credit Card review.

If you’ve been rejected elsewhere or struggled with money before, this option stands out. It’s not just accessible—it helps shape your future credit profile with consistent use.

No complex rewards, no hidden catches—just a simple credit card offering real impact. Ideal for UK residents starting over or needing structure for credit improvement.

| Feature | Details |

| Representative APR | 34.9% variable |

| Interest-Free Days | Up to 56 days if balance is paid in full |

| Annual Fee | £0 – no annual maintenance charge |

| Credit Limit | £200–£1,500 (can increase with responsible use) |

Is this a good option for me?

Rebuilding credit takes consistency—and the right tool. This card supports that journey with transparent terms, manageable limits, and timely upgrade potential when used correctly and responsibly.

The Capital One Classic Credit Card review shows it’s less about perks and more about function. It’s built to help you form solid financial habits, even if your history isn’t perfect.

You don’t need a premium income or pristine report. You just need to prove you can manage credit over time. This card gives you a fair and structured chance to do that.

Credit building potential

This card is designed to show lenders you’re reliable. If you make payments on time and stay within your limit, your credit score may gradually increase.

It reports to major UK credit bureaus, which means consistent use can positively impact your history. A small limit helps users stay disciplined and focused on improvement.

No annual fee

Forget unnecessary maintenance costs. The Capital One Classic is free to keep, making it a stress-free option for long-term use. You only pay if you carry a balance.

Even better, the lack of a fee means you won’t feel pressured to spend just to justify the card. That simplicity is key in this Capital One Classic Credit Card review.

Soft search tool

Before you apply, you can use QuickCheck to find out if you’ll be accepted. It’s a soft search, so it won’t impact your credit file at all.

This reduces the anxiety many applicants feel. Knowing your chances upfront builds confidence and avoids unnecessary rejections that might hurt your credit profile.

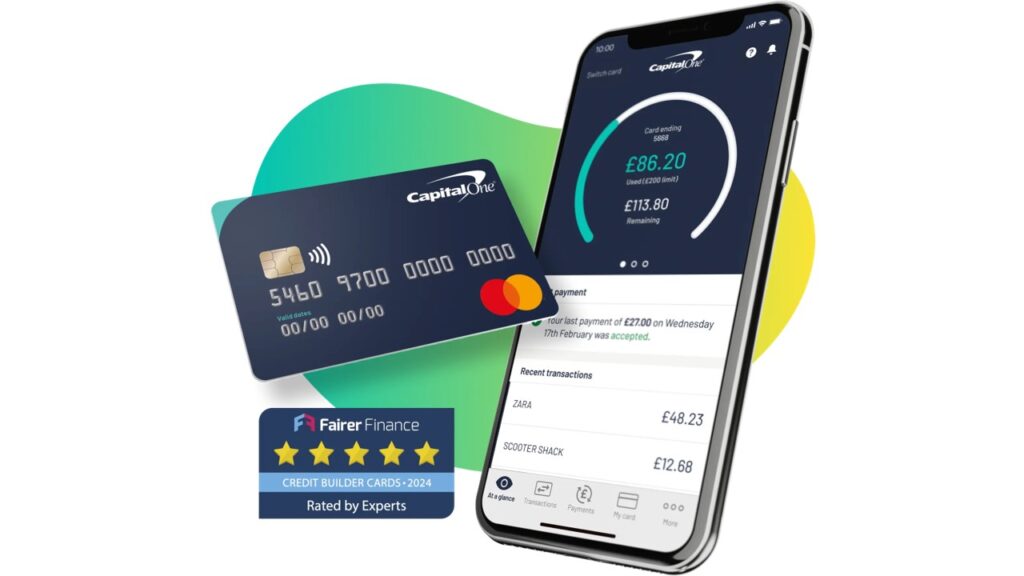

Alerts and app controls

The Capital One app allows you to set alerts, monitor usage, and even freeze your card if needed. These tools make managing your balance much easier.

Digital-first security features also reduce fraud risk. You’ll receive notifications if something looks off, and you can act instantly to stop transactions or report your card lost.

Eligibility for credit increases

Use the card well for a few months and you could receive a higher limit. That could improve your credit utilisation ratio and give you greater flexibility.

While this shouldn’t be your goal alone, it’s a rewarding feature that builds trust between you and the issuer. It also reflects well in your Capital One Classic Credit Card review.

Review the Capital One Classic Credit Card fees and interest rates

This card keeps things relatively straightforward—but you’ll still want to know where fees or interest may apply. Awareness can prevent unwanted charges or credit score dips.

In this Capital One Classic Credit Card review, you’ll see that while fees exist, most can be avoided with responsible use and by paying in full each month.

Fees explained

🔹 Late payment fee: £12 if your monthly payment isn’t made by the due date. It can also harm your credit score.

🔹 Over-limit fee: £12 if you exceed your credit limit—even by a penny.

🔹 Foreign usage fee: 2.75% on any non-sterling transaction, including travel purchases or online shops based abroad.

Interest Rates explained

🔸 Representative APR: 34.9% variable. This applies if you carry a balance month-to-month.

🔸 Cash withdrawals: 34.9% interest from the transaction date plus a 3% fee (min £3).

🔸 Purchases: You may get up to 56 days interest-free if you pay in full each month.

What can this credit card do for me: pros and cons

If you want simplicity and control while building credit, this card may suit you well. It’s designed with learning and progress in mind—not luxury perks.

In this Capital One Classic Credit Card review, we’ll weigh the strongest benefits against its limitations to help you decide with confidence.

Pros

✅ No annual fee: You won’t pay anything to keep this card active, which makes it low-risk for long-term credit building.

✅ Builds your credit: Capital One reports to major UK credit agencies—on-time payments help improve your credit history and score gradually.

✅ QuickCheck tool: Find out if you’re likely to be approved without harming your credit score. Great for avoiding unnecessary rejections.

✅ Mobile app & controls: Track spending, freeze your card instantly, and get real-time alerts—all from the easy-to-use Capital One app.

✅ Credit limit increases: After months of responsible use, you may be eligible for a higher limit, which helps with credit utilisation.

Cons

⚠️ High APR (34.9%): Carrying a balance is expensive. You should aim to pay in full each month to avoid interest.

⚠️ Low starting limit: Initial credit limits can be modest (£200–£500), which might not meet all your needs early on.

⚠️ No perks or rewards: This card doesn’t offer cashback, points, or other benefits—its purpose is strictly credit building.

⚠️ £12 penalty fees: Late payments or going over your limit result in automatic £12 fees and may hurt your credit.

⚠️ Foreign use is costly: Using the card abroad or on non-sterling purchases comes with a 2.75% foreign transaction fee.

Can I apply for this credit card?

Not everyone will qualify—but if you have some credit history or are rebuilding, the requirements are fair and inclusive. You don’t need a perfect record.

As seen in this Capital One Classic Credit Card review, the card welcomes applicants with less-than-ideal pasts—but you’ll need to meet the basics below.

✔️ Must be at least 18 years old

✔️ UK resident with a permanent address

✔️ Have some history of credit (e.g., bills, loans, overdrafts)

✔️ Not currently bankrupt or with active CCJs

✔️ Must not already hold another Capital One card

How to apply for the Capital One Classic Credit Card!

Applying is fast and mostly digital. You’ll know your eligibility in minutes, and the process is user-friendly with minimal paperwork or waiting time.

This Capital One Classic Credit Card review outlines the full application process to help you move forward without stress or confusion.

Step 1: Use the QuickCheck tool

Go to the official Capital One site and find the QuickCheck tool. This lets you see your eligibility without affecting your credit score—ideal for cautious applicants.

It’s a soft search, meaning it won’t appear on your report. It simply helps you understand whether you’re likely to get approved before completing a full application.

Step 2: Submit your personal information

Fill in details like name, address, employment status, and income. This helps Capital One assess your profile accurately and assign a responsible limit if approved.

At the end of this step, you’ll have officially submitted your application for the Capital One Classic Credit Card review.

Step 3: Wait for the instant decision

Most applicants get a decision in about 60 seconds. You’ll be told if you’re approved and what your starting credit limit will be based on your information.

If more information is needed, they’ll let you know. Otherwise, the card will arrive by post within about seven days after approval.

Step 4: Activate your card online or via app

Once it arrives, activate it via the Capital One app or the website. This is when you can start using the tools to manage and monitor your account.

Set alerts and notifications to stay on top of due dates, spending, and credit-building milestones—making the most of your credit journey.

Step 5: Use it wisely and pay on time

To build credit, keep usage below your limit and always pay at least the minimum on time. Full payments avoid interest entirely in the Capital One Classic Credit Card review.

Paying in full every month not only avoids charges but also helps boost your credit score—making future borrowing easier and more affordable.

Is the Capital One Classic Credit Card really worth it?

This card may not offer flashy perks, but it does deliver something more valuable—an opportunity to improve financial standing over time, with clear and fair conditions.

As this Capital One Classic Credit Card review showed, it’s a tool—not a luxury. Use it responsibly, and it becomes a stepping stone toward better credit and confidence.

The lack of an annual fee makes it a keeper—even if you rarely use it. And the QuickCheck feature reduces the risk of applying blindly.

Looking for a slightly more feature-rich option? Check out our review of the TSB Advance Credit Card and see if it offers the benefits you’re after.

TSB Advance Credit Card Review: Smart Simplicity!

Looking for a low-interest credit card with no annual fee and fast approval? This option might be exactly what your wallet has been waiting for.