Why millions of drivers rely on a company that combines reliability, flexible cover, and trusted service!

For decades, Direct Line has been recognised as one of the UK’s most established insurers, supporting drivers with tailored protection. Customers frequently value clarity and dependability, highlighted in this Direct Line Insurance review.

Its innovative approach began with selling policies directly to consumers, avoiding middlemen and reducing unnecessary costs. This strategy reshaped the market and made comprehensive protection more accessible across the nation.

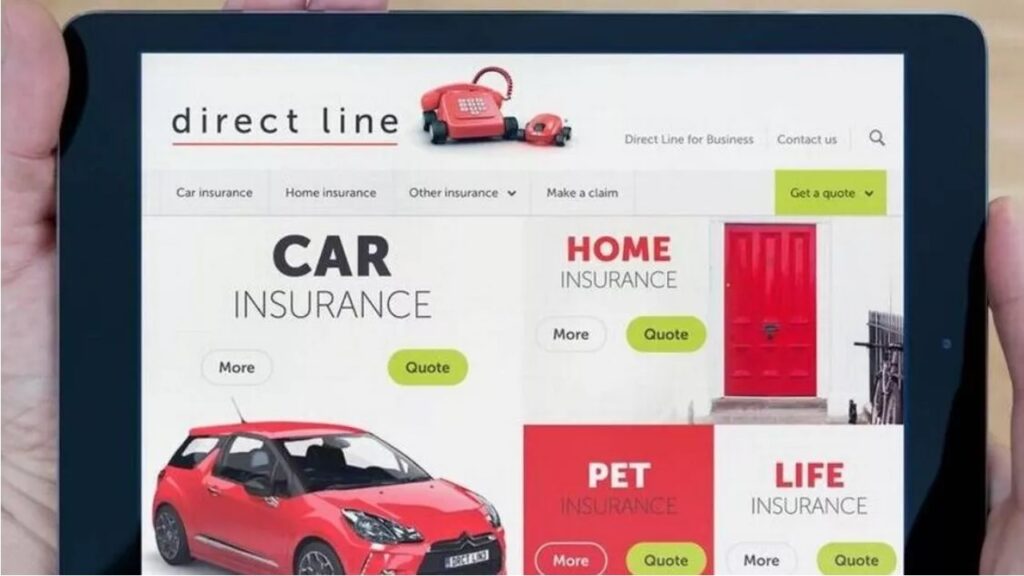

Today, the company offers car, home, and multi-product policies that appeal to families and individuals alike. Its reliability continues to position Direct Line as a leading UK insurance provider.

| Feature | What it Means for You |

| Level of Cover | Options include third party, third party fire and theft, or comprehensive, ensuring flexibility for different needs. |

| Average Annual Cost | Mid-range pricing compared to other insurers, balancing affordability with dependable cover choices across policy levels. |

| Customer Ratings | ⭐⭐⭐⭐☆ – Many customers praise efficient claims handling, though some mention premium increases at renewal. |

| Extras Available | Optional benefits such as breakdown assistance, courtesy car provision, and legal protection enhance peace of mind. |

Information on this page is for general guidance only. We do not provide insurance directly. Quotes and cover will vary depending on your personal circumstances and chosen provider. Always check the terms of your policy before taking out car insurance.

Types of cover available

Direct Line ensures motorists can choose from different levels of protection. Transparency in policies makes it easier for drivers to match cover with both lifestyle and budget considerations.

According to customer feedback, this clarity remains one of the insurer’s biggest strengths. Many UK drivers highlight it when discussing their experiences in a Direct Line Insurance review online.

Each policy option offers a balance between affordability and peace of mind. Whether choosing the legal minimum or comprehensive cover, the insurer provides clear explanations to help motorists decide confidently.

Third Party Only

This is the most basic form of cover, meeting legal requirements by protecting against damage to other vehicles and property. It’s the simplest option for cost-conscious drivers.

While limited in scope, it guarantees compliance with UK law. It’s often chosen by those seeking affordability, particularly when driving older vehicles with lower replacement values.

Third Party Fire and Theft

Beyond third party, this cover includes protection if the car is stolen or damaged by fire. It appeals to drivers wanting security beyond minimum requirements at moderate cost.

Customers frequently mention this as a balanced option in a Direct Line Insurance review. It bridges affordability with additional reassurance, making it a popular mid-tier choice.

Comprehensive Cover

The most complete policy option, covering both your car and third parties. It suits drivers who want full financial protection, especially for newer or high-value vehicles.

Comprehensive cover also allows add-ons like breakdown recovery or legal protection. It’s frequently recommended by advisers for motorists prioritising long-term value and total peace of mind.

Why UK drivers choose them

Direct Line’s reputation rests on simplicity, reliability, and customer service. UK drivers often highlight its practical approach, noting how its policies adapt to different financial and driving circumstances.

Another common theme in feedback is peace of mind. Many testimonials within a Direct Line Insurance review emphasise trust in the company’s stability and accessible claims support throughout emergencies.

Efficient Claims Handling

The company is praised for responsive claims management. Drivers highlight smooth processes that reduce stress, especially in urgent scenarios where efficiency and communication are crucial.

This responsiveness reinforces trust, making Direct Line a preferred choice for motorists who prioritise quick solutions and fair outcomes when accidents disrupt daily life.

Flexible Options

Flexibility ensures policies meet unique needs. Drivers can customise levels of excess and extras, tailoring protection in ways that better reflect individual driving habits or family circumstances.

This adaptability is frequently emphasised in this Direct Line Insurance review. Customers appreciate freedom to design policies that balance cost control with necessary coverage.

Competitive Value

Pricing remains a strong factor. Policies are typically mid-market, offering strong benefits relative to cost. Bundling options and discounts add further appeal for multi-policy households.

For many UK motorists, balancing affordability with reliability is essential. Direct Line achieves this through consistent value across product tiers, strengthening its reputation among budget-conscious drivers.

Trusted Legacy

With decades in the industry, the company’s name carries authority and reassurance. A long-established presence helps customers feel secure in choosing a well-recognised insurer.

In fact, many highlight this legacy in a Direct Line Insurance review. It differentiates the provider from newer entrants lacking the same track record of trust.

Things to consider before choosing

Every motorist should evaluate costs, cover, and service quality before committing. Policies vary, so ensuring terms suit personal circumstances helps secure the best possible insurance experience.

A Direct Line Insurance review can reveal useful insights. However, personal comparison of features, exclusions, and renewal prices remains vital for making decisions that truly align with driving needs.

⚠️ Renewal Increases: Some customers note higher premiums at renewal. Comparing offers annually helps avoid paying more than necessary over time.

⚠️ Extras Costs: Breakdown and legal cover add value but raise costs. Always weigh whether these additions are worth the extra expense.

⚠️ Claims Experience: While often praised, claims can sometimes involve delays. Review policy details to understand expectations during unexpected incidents.

⚠️ Exclusions: Comprehensive cover still carries limitations. Checking small print ensures there are no surprises when making a claim.

Average costs and value for money

Drivers prioritise insurers that balance competitive pricing with strong service. Understanding general cost ranges helps motorists gauge affordability before securing a policy.

A Direct Line Insurance review often positions the company mid-market, appealing to those who value quality cover without excessive premiums. Still, every driver’s quote depends on personal risk factors.

🔸 Young Drivers: Policies often cost more due to higher risk, though optional extras sometimes improve overall value.

🔸 Experienced Drivers: Many report paying between £650–£800 annually, depending on history and cover type selected.

🔸 Multi-Car Households: Discounts help reduce overall expenses, particularly when insuring multiple vehicles under the same policy.

🔸 Low-Mileage Motorists: Flexible policies occasionally offer savings for drivers covering fewer miles than average annually.

Step-by-step: from quote to cover

Direct Line aims to simplify the path from quote to active policy, ensuring transparency at each stage of the process.

A Direct Line Insurance review often highlights this step-by-step clarity as a major strength, reflecting the company’s focus on making insurance less complicated for UK drivers.

Step 1: Request a Quote

Visit the website or call for a tailored quote. Provide personal details, driving history, and vehicle type to generate accurate pricing and available policy levels.

This process is quick, with comparisons shown immediately. It allows motorists to see differences between third party, fire and theft, or comprehensive cover before making any decision.

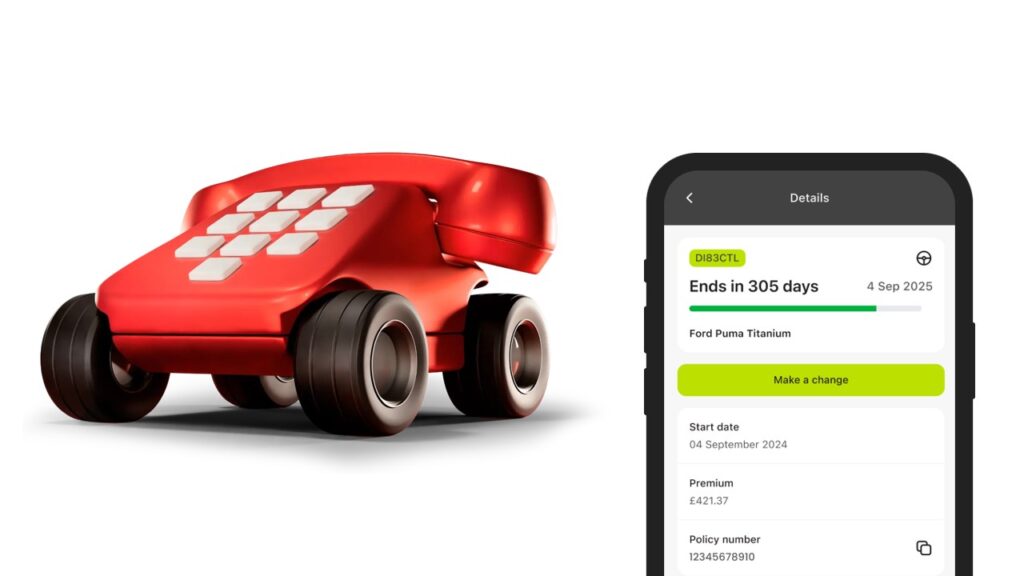

Step 2: Customise Policy

Adjust voluntary excess and extras such as breakdown or legal cover. These customisations ensure policies reflect lifestyle, budget, and driving needs effectively.

Flexibility is praised repeatedly in this Direct Line Insurance review. The ability to adapt cover reassures customers they’re not locked into unsuitable terms.

Step 3: Confirm Information

Drivers must check details carefully, ensuring accuracy with no-claims history and personal information. Mistakes may affect claims or invalidate policies entirely if not corrected before final confirmation.

This stage ensures transparency and fairness. Direct Line encourages accuracy, reinforcing its reputation for honest dealings with customers across all policy stages.

Step 4: Secure Payment

Payment activates the policy almost immediately, granting legal cover without delay. Flexible payment methods suit different preferences, including monthly instalments for better budget management.

Documentation arrives digitally or by post. Drivers benefit from clear confirmation of cover, allowing confidence in their policy from day one.

Step 5: Access Support

After purchase, customer service and 24/7 support become available. This ensures policyholders can access assistance quickly during emergencies or questions regarding cover.

Such accessibility was frequently emphasised in this Direct Line Insurance review, with customers highlighting support as a key reason for continued loyalty.

Other insurers worth considering

Direct Line’s long-standing presence ensures wide appeal. However, comparing policies with alternatives can reveal different benefits, helping drivers make decisions that reflect their unique circumstances.

This balanced Direct Line Insurance review confirms its strengths but also encourages exploring options. This comparison ensures customers find protection aligned with both needs and budget.

Admiral remains a popular alternative. Its multi-car policies and flexible pricing attract many UK drivers, complementing Direct Line’s more traditional approach with competitive, tailored solutions.

For deeper insights, explore our full Admiral review. Comparing multiple providers ensures you secure the most effective protection for your personal driving circumstances and long-term financial priorities.

Admiral Insurance Review: True Value!

Compare cover types, typical costs and useful extras. See how policies fit different driver profiles, so you can weigh value, and support before getting a quote!