Get student financial independence with a card designed to build credit and manage spending!

Starting university often means managing your finances independently for the first time. This requires the right tools, which is why many students search for an informative HSBC Student Credit Card review.

The HSBC Student Credit Card provides simple terms, fair rates, and tailored benefits. It’s designed to help students succeed financially without adding unnecessary burdens during their studies.

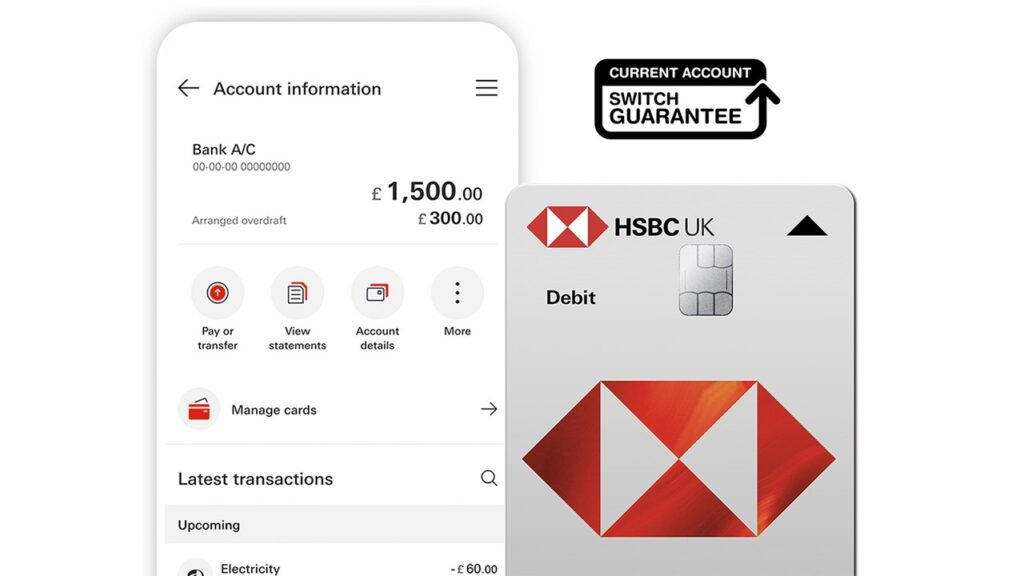

Accessible exclusively to HSBC Student Bank Account holders, the card delivers practical features such as interest-free periods, purchase protection, and rewards, ensuring a supportive experience for first-time credit users.

| Feature | Details |

| Representative APR | 18.9% variable |

| Intro Offer | Up to 56 days interest-free on purchases if balance cleared |

| Annual Fee | £0 (no annual maintenance cost) |

| Credit Limit | £250 to £500 depending on applicant profile |

All rates, fees, and offers were accurate at the time of writing but may change. Please check HSBC’s official website for the latest details.

Is this a good option for me?

A student card provides manageable access to credit while offering financial protection. It’s not about luxury benefits but about learning essential money skills through controlled borrowing.

According to this HSBC Student Credit Card review, the card balances affordability with security. Its clear features, including no annual fee, modest limits, and purchase protections, make it an excellent first step.

Students looking for flexibility and long-term financial growth benefit most. Using the card wisely builds creditworthiness while offering convenience, especially when integrated with HSBC’s modern mobile banking technology.

Build Credit History Safely

This card helps establish positive credit history, vital for future loans and mortgages. Responsible repayment demonstrates reliability and fosters trust with future lenders across the UK.

HSBC ensures limits remain modest, preventing students from overextending. This focus on financial responsibility makes it easier for young borrowers to develop strong habits that endure after graduation.

Fair Student-Friendly Fees

Affordability matters when studying. With no annual fee and transparent terms, this card ensures students avoid hidden charges and maintain control over everyday financial commitments.

The HSBC Student Credit Card review highlights its low entry barrier, delivering clarity for applicants who want a fair deal without complicated fee structures that add unnecessary stress.

Everyday Payment Convenience

Students benefit from secure transactions through contactless technology and compatibility with Apple Pay, Google Pay, and Samsung Pay. This makes everyday payments easier, safer, and quicker on campus or online.

Convenience encourages responsible usage, as tracking transactions through HSBC’s mobile app ensures students always know their balance and upcoming payments, reducing the risk of accidental overspending.

Reliable Purchase Protection

Section 75 of the Consumer Credit Act covers purchases between £100 and £30,000. This gives students confidence when shopping online or paying for important essentials.

HSBC adds peace of mind with strong security measures, ensuring unexpected issues like faulty goods or canceled services do not compromise a student’s budget or experience.

Rewards and Discounts

HSBC’s “Home & Away” rewards scheme allows students to enjoy discounts on dining, shopping, and travel, adding extra value without additional costs.

As the HSBC Student Credit Card review confirms, these rewards enhance usability, offering everyday perks that stretch student budgets further while maintaining essential security and simplicity.

Review the HSBC Student Credit Card fees and interest rates

Managing costs is essential for students. HSBC offers clear information on fees and interest, helping students borrow responsibly and avoid hidden surprises. Transparency makes this card highly competitive.

The HSBC Student Credit Card review emphasizes its accessible APR, combined with an interest-free period if balances are cleared on time, reinforcing good financial habits early.

Fees explained

- 🔹 Annual Fee: £0, allowing students to own the card without yearly maintenance costs.

- 🔹 Foreign Transaction Fee: 2.99% on overseas purchases, important when traveling or studying abroad.

- 🔹 Cash Withdrawal Fee: 2.99% plus minimum £3 for ATM withdrawals, discouraging unnecessary cash advances.

Interest Rates explained

- 🔸 Representative APR: 18.9% variable, competitive for a student-focused product.

- 🔸 Purchase Interest: Up to 56 days interest-free if balance cleared in full each month.

- 🔸 Cash Advance Interest: Charged immediately with higher rates, making it the most expensive borrowing method.

What can this credit card do for me: pros and cons

Students should carefully consider both the advantages and limitations. Balancing these ensures informed decisions that align with long-term goals and everyday financial needs.

As this HSBC Student Credit Card review highlights, the product works best for those prioritizing simplicity, responsibility, and controlled credit growth.

Pros

- ✅ No Annual Fee: This card charges no yearly fees, keeping student costs significantly lower.

- ✅ Purchase Protection: Section 75 coverage protects against issues, providing strong security for everyday online shopping experiences.

- ✅ Build Credit History: Responsible repayment habits help students establish a good credit record for future opportunities.

- ✅ Mobile Integration: Spending and balances are tracked through HSBC’s app, encouraging smarter budgeting and financial responsibility.

- ✅ Student Rewards: Access discounts on restaurants, shops, and travel through HSBC’s reward scheme, maximizing limited budgets wisely.

Cons

- ⚠️ Limited Credit Limit: With only £250–£500 available, borrowing power remains very restricted for emergencies.

- ⚠️ Foreign Transaction Fees: Overseas purchases are charged 2.99%, making this card unsuitable for frequent travelers abroad.

- ⚠️ Cash Advance Costs: Withdrawals incur high fees and immediate interest, discouraging students from unnecessary cash advances.

- ⚠️ Eligibility Restriction: Applicants must hold an HSBC Student Account, preventing other students from considering this credit option.

- ⚠️ No Sign-Up Bonus: Unlike competitors, this card offers no cashback, freebies, or introductory incentives whatsoever.

Can I apply for this credit card?

Applying requires meeting eligibility requirements. HSBC keeps criteria straightforward to ensure responsible lending, offering students a safe route into credit without unnecessary complications.

The HSBC Student Credit Card review clarifies that only certain applicants qualify, mainly existing student account holders who demonstrate residence, age, and education commitments.

- ✔️ Age Requirement: Applicants must be at least 18 years old when submitting their official application.

- ✔️ Residency: Only UK residents, generally with at least three years’ residence history, are eligible applicants.

- ✔️ Account Requirement: Students must already have a valid HSBC Student Bank Account before applying successfully.

- ✔️ Education Proof: Applicants need confirmation of enrollment in higher education, ensuring they’re full-time qualifying students.

- ✔️ Creditworthiness: HSBC assesses responsible financial standing, including repayment ability, before confirming final eligibility for students.

How to apply for the HSBC Student Credit Card!

The application process is simple, especially for existing HSBC Student Account holders. Most students can complete their request online, via mobile banking, or in branch.

This HSBC Student Credit Card review outlines the main steps, ensuring applicants understand the process fully before committing to the card.

Step 1: Log Into Online Banking

Begin by accessing HSBC’s online banking portal or mobile app. This ensures personal details are securely managed, and account verification begins immediately, making the application process smoother.

Take time to check existing account details are up-to-date. Errors can delay approval, so verifying personal and contact information beforehand is a wise first step.

Step 2: Locate the Credit Card Application

Navigate to the credit cards section, then select the student option. HSBC provides clear instructions, making it easy to find and complete the required fields quickly.

Submit accurate academic details and confirm student account status. This ensures HSBC processes eligibility smoothly, finalizing the HSBC Student Credit Card review at this stage for new applicants.

Step 3: Provide Your Personal Information

Students must enter full details including name, address history, and income. These fields establish identity and help HSBC assess whether the applicant meets credit standards.

Double-check spelling and accuracy. Submitting correct information minimizes delays and ensures the approval process moves forward efficiently without unnecessary requests for further documentation.

Step 4: Review the Application Carefully

Before submitting, applicants should check each section thoroughly. Reviewing eligibility and fee details ensures full understanding of responsibilities associated with the HSBC Student Credit Card.

Confirming accurate entries prevents rejections or errors. Careful review demonstrates commitment and helps ensure smoother processing, reflecting positively on the applicant’s attention to detail.

Step 5: Submit and Wait for Decision

Once submitted, HSBC evaluates the application promptly. The decision typically arrives within days, depending on account history and credit assessment. Communication is handled via email or mobile alerts.

Successful applicants can expect their physical card soon after. This finalizes the HSBC Student Credit Card review, confirming eligibility and welcoming students into responsible financial independence.

Is the HSBC Student Credit Card really worth it?

Students seeking a simple, responsible credit product will find this option effective. Its low fees, protections, and accessible limits make it valuable for first-time borrowers learning discipline.

According to this HSBC Student Credit Card review, the card is competitive, but primarily suits those already banking with HSBC. Its restrictive eligibility limits broader access among students.

Still, the product’s strengths outweigh weaknesses. Building credit history, protecting purchases, and delivering convenience justify its popularity among students seeking safe financial growth.

For those desiring an alternative with broader availability, consider the HSBC Classic Credit Card. Check our full review to see how it compares and whether it’s right for you.

HSBC Classic Credit Card Review: Classic Advantage

Build your financial future with a trusted option tailored for simplicity. Perfect for those looking to manage money smartly and grow their credit responsibly.