Apply in minutes without hurting your credit!

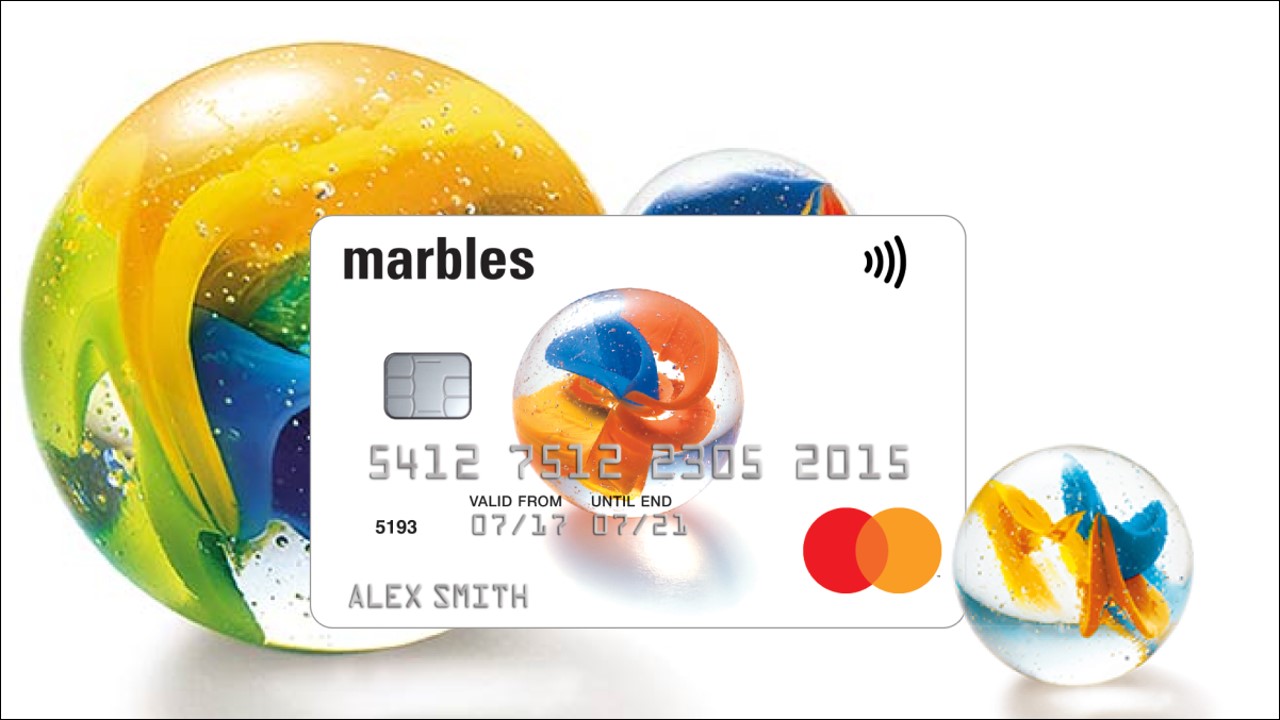

Get up to £1,500 with no annual fee with the Marbles Credit Card!

The Marbles Credit Card helps you build your credit score with no annual fee, flexible payment dates, and limits up to £1,500. Easily manage spending online or via app, and improve your financial future—apply safely without impacting your score.

Discover the top benefits of the Marbles Credit Card!

You will remain in the same website

Build Back Better: The Marbles Credit Card in Focus

If your credit history has a few bumps, the Marbles Credit Card offers a second chance with fair terms. It’s tailored for those seeking responsible credit rebuilding.

This card is issued by NewDay Ltd, a well-known UK financial services provider. It’s regulated, transparent, and doesn’t trap you in hidden fees or complex conditions.

The Marbles Credit Card starts with a credit limit between £250 and £1,500. That limit can grow over time with good usage and timely payments, rewarding financial discipline.

There’s no annual fee, so cardholders aren’t penalised for simply having the card. It’s a solid feature that lowers the cost of rebuilding your credit.

Application is easy thanks to the soft eligibility check, allowing you to see if you qualify before undergoing a hard credit inquiry that might affect your score unnecessarily.

Mobile app integration gives full control over spending, statements, and payment dates. The card suits everyday purchases, budgeters, and anyone focused on repairing their credit track record.

Why It Works for Everyday Credit Recovery

Rebuilding credit isn’t about perks—it’s about structure, predictability, and control. Marbles delivers just that, especially if you’ve been declined elsewhere or need a simple financial restart.

What separates it from other cards is the combination of flexibility and accessibility. It was built for users who need breathing space, not high limits or cashback rewards.

🔹 No Annual Fee: You’ll never be charged just for owning the card, making it ideal for low-budget users working to regain control of their finances.

🔹 Credit Limit Growth: Initial limits start low, but consistent payments often unlock higher limits over time—encouraging gradual trust-building with lenders.

🔹 Soft Eligibility Check: You can safely check if you’re likely to be approved without damaging your credit score. Great for cautious applicants or those unsure of approval odds.

🔹 Manageable Mobile Tools: Control your card via app or browser—adjust payment dates, track spending, receive alerts, and monitor activity in real time with user-friendly tech.

🔹 Supports Credit Building: Marbles reports to the three major UK credit reference agencies. Responsible usage improves your score and opens doors to better cards later on.

What You Should Watch Out For

No credit product is perfect, and Marbles is no exception. While it’s great for building credit, you need to use it wisely to get long-term value.

High interest, lack of rewards, and cash withdrawal charges make it a card best suited to strict, responsible users—not those planning to carry a balance monthly.

🔸 High APR (34.9%): This rate can be costly if you don’t pay your balance in full. Interest accumulates fast, even on small unpaid amounts.

🔸 No Intro Offers: Unlike many credit cards, Marbles doesn’t offer 0% purchases or transfers. You’re paying full rate from the start unless you clear it monthly.

🔸 Cash Advance Fees: Withdrawing cash costs 5% (min £4) and begins accruing interest immediately—there’s no grace period, so it should be avoided entirely if possible.

🔸 No Rewards or Cashback: You won’t earn points, discounts, or perks. This card is strictly about credit rebuilding—nothing more, nothing less.

🔸 Mixed Service Reviews: While the app and interface are praised, customer support has received criticism for slow response times and lack of flexibility during disputes.

Yes — Marbles is specifically designed for people with limited or poor credit history. The card uses a soft eligibility check first, so there’s no risk to your credit score. If approved, it gives you a chance to build trust with lenders through responsible use and on-time payments.

If you consistently pay your full balance, you’ll avoid all interest charges completely. This also boosts your credit score over time, shows financial responsibility, and may lead to higher credit limits. It’s the ideal way to use Marbles: pay in full, avoid debt, and improve your credit profile.

Not automatically—but if you use the card sensibly, make on-time payments, and stay within your limit, Marbles may offer a credit limit review after a few months. Responsible behaviour gets rewarded. It’s a gradual process, but many users report limit increases after three to four months of use.

You can use it abroad, but there is a 2.95% foreign exchange fee. That means you’ll pay extra for every international transaction. While it’s not ideal for travel spending, it can still be useful in emergencies overseas—just be aware of the added costs on each non-UK purchase.

A Practical Alternative to Consider

For users who want fewer limits and a more traditional credit experience, there are alternatives worth considering. One standout is the TSB Advance Credit Card.

While Marbles focuses on repairing damaged credit, TSB’s offering appeals to those ready to take the next step—still responsible, but with room to grow.

TSB Advance offers a lower APR, introductory perks, and broader everyday utility. It’s perfect for those who’ve started rebuilding and want a more complete credit experience.

If you’re past the credit recovery stage or want a card with wider benefits, check our full TSB Advance Credit Card review before making your decision.

TSB Advance Credit Card Review: Smart Simplicity!

Looking for a low-interest credit card with no annual fee and fast approval? This option might be exactly what your wallet has been waiting for.