Build credit history and access tailored features with the Vanquis Credit Builder Card!

Starting your financial journey with the right credit card can be life-changing. For many UK residents, the Vanquis Credit Builder Card review shows how responsible use strengthens financial foundations.

This card was designed with accessibility in mind. People with limited or poor credit history can finally access manageable credit limits while steadily improving their profile over time through consistent repayments.

By offering modest starting limits, competitive control tools, and essential features, Vanquis provides a pathway toward rebuilding trust with lenders while empowering users to take control of their finances responsibly.

| Feature | Details |

| Representative APR | 37.9% variable (depending on personal circumstances) |

| Intro Offer | 56 days interest-free on purchases if paid in full and on time |

| Annual Fee | £0 (no ongoing cost for maintaining the account) |

| Credit Limit | Between £250 and £2,500, based on credit history and affordability |

All rates, fees, and offers were accurate at the time of writing but may change. Please check Vanquis’ official website for the latest details.

Is this a good option for me?

The Vanquis Credit Builder Card was built for everyday people who need access to credit, but with a safer, more controlled approach to borrowing and managing finances.

By using it responsibly, you can establish a steady record of timely repayments. This Vanquis Credit Builder Card review proves it’s not about perks, but about rebuilding financial trust.

For those committed to improvement, the card brings reassurance. With no annual fee, a reliable app, and regular credit reporting, it’s a practical tool for growth.

Credit Limit Flexibility

Starting limits are deliberately low, ensuring applicants don’t overextend themselves. Over time, limits can increase based on responsible use, giving flexibility while ensuring customers learn positive spending habits carefully.

This growth strategy supports sustainable borrowing. Applicants gradually gain access to larger limits, reinforcing responsible habits and encouraging stronger financial confidence without the risks of immediate, excessive debt exposure.

Interest-Free Period

Every purchase offers up to 56 days interest-free if you clear the balance in full. This benefit allows short-term flexibility while building repayment discipline with consistency.

As highlighted in our Vanquis Credit Builder Card review, using this feature smartly ensures you enjoy manageable borrowing without unnecessary charges, provided your payments remain on time every single month.

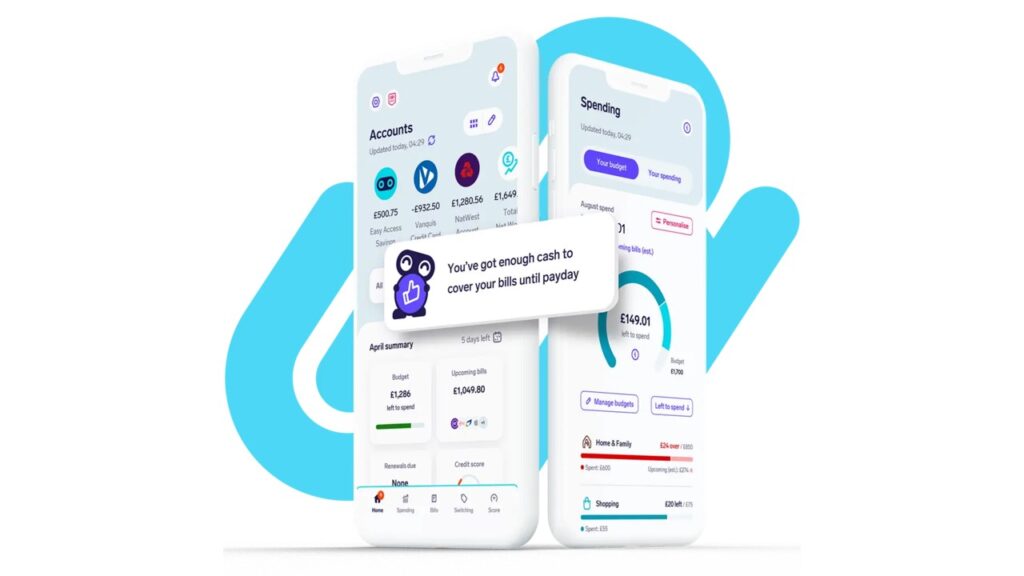

Mobile App Support

Vanquis provides an intuitive mobile app. It enables easy account management, payment scheduling, and spending tracking. Users can set reminders and control their card securely at any time.

Having constant oversight means fewer missed payments and a better chance to build credit responsibly. The app truly transforms complex financial tasks into simple, daily habits anyone can manage.

Payment Protection

The card includes optional repayment protection features. These can provide coverage in cases of illness, redundancy, or unexpected life events, giving peace of mind and security to vulnerable applicants.

While not mandatory, having the option demonstrates Vanquis’ understanding of its users’ unique needs. This approach reassures cardholders that their financial health is prioritized, even during challenging life situations.

Long-Term Growth

By maintaining positive usage, customers may access gradual limit increases. Each increase reflects improved credibility. This builds confidence and ensures cardholders maintain momentum toward stronger long-term borrowing potential.

Our Vanquis Credit Builder Card review confirms that beyond credit repair, this card offers a stepping stone. It’s about building a sustainable financial journey for the future.

Review the Vanquis Credit Builder Card fees and interest rates

Transparency is key. Applicants must fully understand charges before applying. The Vanquis Credit Builder Card keeps things straightforward, with limited fees and clearly defined interest rates for easier planning.

As you’ll see in this Vanquis Credit Builder Card review, the APR is higher than prime market averages. However, its purpose isn’t cheap borrowing—it’s credit building through disciplined use.

Fees explained

- 🔹Late Payment Fee: £12 charge if payments are missed, underlining the importance of setting up reminders or direct debit.

- 🔹Cash Withdrawal Fee: 3% (minimum £3), making ATM use more expensive than purchases.

- 🔹Foreign Usage Fee: 2.99% fee applied to overseas transactions, increasing total costs when traveling abroad.

Interest Rates explained

- 🔸Representative APR: 37.9% variable, tailored to each applicant’s affordability profile and credit record.

- 🔸Purchase Rate: 37.9% APR, manageable only if balances are cleared monthly.

- 🔸Cash Advance APR: Higher interest applies immediately on withdrawals, reinforcing why this card is better for purchases than cash.

What can this credit card do for me: pros and cons

The Vanquis Credit Builder Card empowers applicants with limited credit access, but higher fees and fewer perks mean it requires thoughtful, disciplined usage to achieve positive long-term results.

Our Vanquis Credit Builder Card review stresses balance: build your credit successfully if used responsibly, but recognize potential pitfalls if minimum payments are missed or balances are carried long-term.

Pros

- ✅ Accessible Approval: Designed for people with poor or limited credit history, making application success significantly easier.

- ✅ No Annual Fee: Enjoy affordable borrowing without yearly costs, helping applicants maintain tighter control over spending.

- ✅ Interest-Free Window: Benefit from up to 56 days interest-free when balances are fully repaid monthly.

- ✅ Mobile App Tools: Track spending, schedule payments, and manage accounts conveniently through Vanquis’ user-friendly mobile app.

- ✅ Credit Growth Potential: Responsible usage can gradually increase credit limits, strengthening trustworthiness with future mainstream lenders.

Cons

- ⚠️ High APR: At 37.9% variable, interest costs are expensive if balances aren’t cleared monthly.

- ⚠️ Cash Withdrawal Fees: Cash advances incur high charges, making everyday ATM usage very financially unwise.

- ⚠️ Foreign Usage Charges: Overseas purchases attract a 2.99% fee, discouraging frequent travelers from choosing this option.

- ⚠️ Limited Rewards: Card lacks cashback, points, or perks, focusing purely on credit building functionality only.

- ⚠️ Potential for Debt: Carrying balances at high rates increases risks of debt spirals without disciplined usage.

Can I apply for this credit card?

Eligibility is relatively open, with Vanquis focusing on accessibility. However, approval still depends on affordability, residency, and individual circumstances to ensure applicants are not placed in financial hardship.

Our Vanquis Credit Builder Card review highlights inclusive design. It’s built to welcome those often overlooked by mainstream lenders while balancing approvals with fair, responsible lending practices.

- ✔️ Age Requirement: Must be at least eighteen years old and permanently reside within the United Kingdom.

- ✔️ Income Requirement: Applicants need a stable income source, meeting Vanquis affordability assessments to demonstrate financial responsibility.

- ✔️ Credit Search: Application begins with a soft search, followed by full detailed credit assessment before approval.

- ✔️ Financial Status: Applicants cannot be bankrupt, subject to IVA, or experiencing significant outstanding financial difficulties.

How to apply for the Vanquis Credit Builder Card!

Applying is straightforward. Vanquis focuses on a digital process that gives applicants a clear idea of eligibility before committing, ensuring minimal negative impact if declined.

In fact, our Vanquis Credit Builder Card review shows the online eligibility check helps protect applicants’ credit history while offering transparent outcomes about likely acceptance.

Step 1: Start Online

Visit the Vanquis website and complete the short online eligibility form. This initial step uses a soft search, meaning it won’t leave a visible impact on your report.

Completing this stage provides quick insight. It reassures applicants whether continuing is worthwhile, saving time and safeguarding financial confidence before progressing toward a formal application submission.

Step 2: Review Pre-Approval

After the soft check, applicants see an estimate of credit limits and APR offers. This transparency ensures you know what’s likely available before officially applying.

It’s an essential checkpoint. According to this Vanquis Credit Builder Card review, pre-approval details let applicants assess affordability comfortably before committing to the full, hard search application.

Step 3: Submit Documents

Applicants may need to provide proof of income and identification. This ensures compliance with financial regulations and protects both lender and borrower from potential risks or errors.

Having documents ready speeds up the process. It also gives Vanquis clear visibility into affordability, reducing unnecessary delays during the final decision-making process.

Step 4: Final Approval

Once documents are verified, Vanquis completes a full credit check. If successful, applicants receive official confirmation, with limits and APR finalized according to individual profiles and assessments.

Applicants benefit from this clarity. Final approval offers a firm foundation, enabling customers to move forward confidently toward using their card responsibly and strategically from the very start.

Step 5: Receive and Activate

The card arrives by post along with a PIN. Activation is straightforward, typically completed through the mobile app or automated phone service in just a few moments.

From this point forward, applicants can begin using their card. As emphasized in this Vanquis Credit Builder Card review, the real journey begins with disciplined, responsible borrowing habits.

Is the Vanquis Credit Builder Card really worth it?

For those rebuilding credit, the Vanquis Credit Builder Card is a strong option. While not ideal for heavy spenders, it offers accessible approval and practical financial growth opportunities.

Our Vanquis Credit Builder Card review confirms its role as a stepping stone. Used wisely, it helps users graduate to mainstream cards, enjoying stronger creditworthiness and greater borrowing confidence.

That said, the high APR means carrying balances is costly. This card is only truly valuable when repayments are consistently on time and balances are fully cleared.

If you’re looking for alternatives, the Lloyds Balance Transfer Credit Card offers a broader range of perks. Check out our full review on this competitive product today.

Lloyds Balance Transfer Credit Card Review: Smart

Move your balances to one manageable place, enjoy introductory offers, and simplify your finances with a reliable UK credit card designed for flexibility and security!